The way your employer pays you should be fully transparent. Pay transparency can protect employees from wage theft and other labor code violations committed by employers. California law requires employers to provide wage statements with each pay stub to employees to help ensure they are paid for their time at the proper rates.

If your employer commits pay stub violations in California by failing to provide or providing an inadequate or incomplete wage statement, you may have the right to recover damages and penalties.

We can help you hold your employer accountable for any failure to comply with California’s Labor Code. Our legal team at Workplace Rights Law Group is highly experienced, and we receive top ratings from our clients. Call us today for top-level legal help with your employment issue.

What Are the Pay Stub Requirements in California?

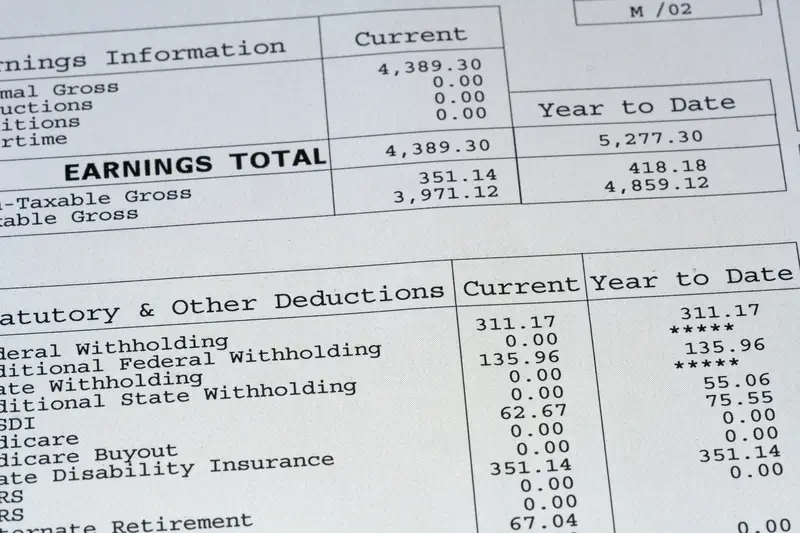

Section 226 of California’s Labor Code requires that employers provide a written, itemized wage statement with each paycheck. This statement must include the following information:

- The applicable pay period,

- Total hours worked,

- Gross wages earned,

- Net wages earned,

- The number of piece-rate units earned (if applicable),

- The applicable piece rate (if relevant),

- All applicable hourly rates in effect during the pay period,

- The number of hours worked at each applicable hourly rate,

- The rate of pay and total hours worked for each temporary services assignment,

- All deductions made,

- The employee’s name,

- The last four digits of the employee’s social security or identification number, and

- The employer’s legal name and address.

What should the pay stub look like? This link from the California Labor Commissioner’s Office provides an example of legal compliant California wage statement for an hourly employee.

What About Exempt Employees, Salaried Employees, and Employees Who Are Paid in Cash?

Remember that even when paid in cash, your employer must give you a written statement with the previously mentioned information at each pay period.

Exempt and salaried employees are also entitled to wage statements for each pay period, but their employers do not have to provide information regarding the total hours worked. Exempt employees are employees who are not entitled to minimum wage or overtime pay, and they include, but are not limited, to the following:

- Workers employed in a professional capacity;

- Salaried computer software professionals;

- Employees in executive positions;

- Outside sales people; and

- Employees in administrative positions;

Your job title alone does not determine whether or not you’re a legally exempt employee. Instead, the nature of your work and other details are essential when determining whether you are a legally exempt employee. So, you should speak to a knowledgeable employment attorney before you let your employer off the hook for any potential infraction of California’s wage statement law.

Call Now

Taking Action Against Pay Stub Violations in California

You may sue for damages if your employer fails to furnish a wage statement with any paycheck. This lawsuit can be a class-action lawsuit covering multiple employees who have suffered from the same infraction.

Remedies Available for Pay Stub Violations

Under California law, employees whose employers do not provide wage statements can receive the amount of their actual damages during the initial pay period and $100 for each additional violation up to a maximum of $4,000.

Employees who sue under this portion of the California Labor Code also have a right to costs and reasonable attorney fees. When you initiate a civil claim, your employer may have 33 days to correct any incorrect wage statement to avoid liability.

Remedies Available for Denied Requests to Inspect Payroll Records

Sometimes, you can begin a wage claim against your employer by asking for your payroll records. In California, you have the right to inspect your payroll records within 21 days of a request to do so, and if your employer denies your request for inspection, you could be entitled to a $750 penalty payment.

Upon inspection of your payroll information, you might discover that your employer has not kept proper records of your time and wages or has not properly paid you for your time (e.g., a minimum wage or overtime violation). You can seek damages or further penalties for these failures by filing a lawsuit in civil court or a wage claim with the California Labor Commissioner’s Office.

Speak to an attorney immediately if you believe your employer has committed any pay stub violations in California. The simplest solution to your issue may be a negotiation with your boss or the filing of a lawsuit. Our Workplace Rights Law Group attorneys can guide you toward the best form of conflict resolution for your specific case and needs.

Workplace Rights Law Group Can Protect Your Rights

At Workplace Rights Law Group, we strive to ensure people in positions of power do not take advantage of their employees. Our attorneys are in the unique position of having represented employers in the past, so our team knows the employer playbook and how to beat employers in court and the negotiation room.

Our attorneys also strive to make sure your specific needs are met when resolving any workplace dispute. We appreciate that you might benefit more from a different approach than what we have used for another client. So, we provide individualized attention to each client in order to formulate the best legal strategy for achieving the best results for each of our clients.

If award-winning, results-driven advocacy and support are what you need in the face of a workplace dispute, we are the team to call. We have recovered millions on behalf of mistreated employees, and we are ready to fight for you. Please do not hesitate to ask for help. You can schedule a case review by calling or contacting us on our website.

Where You Can Find Our Glendale, CA Office Location

Where You Can Find Our Riverside, CA Office Location