Many of us are familiar with receiving our first paychecks and realizing the net amount is far less than anticipated. There are a handful of deductions your employer can lawfully take from your pay, but California Labor Code section 221 outlaws multiple types of wage deductions.

If you are noticing less money in your paycheck, and are unsure why, our knowledgeable attorneys at Workplace Rights Law Group can help you understand those deductions and file a claim against your employer if it has made illegal deductions from your wages. We are top-rated employment attorneys who have recovered millions on behalf of employees around California.

What Does Labor Code 221 Mean for Paycheck Deductions?

Section 221 of California’s Labor Code forbids employers from collecting or receiving money they have paid to their employees.

Employers are rarely authorized to take back money from an employee’s paycheck, even if the employer made an overpayment in a previous paycheck, or the employee made a mistake that cost the employer money. There are some exceptions to the rule, but first, let’s review which California wage deductions are illegal.

Illegal Wage Deductions

Employers in California cannot deduct any portion of an employee’s wages for any of the following reasons:

- To cover the cost of an employee’s work uniform;

- To make up for a past wage advance made in error;

- To cover financial losses caused by an employee, unless the loss was due to an employee’s willful act or gross negligence;

- To pay for business expenses the employee incurred through working;

- To take any portion of the employee’s tips;

- To cover the cost of company property that is damaged by an employee, unless the damage was caused by an employee’s gross negligence or a willful act;

- To cover a required employee bond;

- To pay for employee photographs required by the employer; or

- To cover the cost of physical or medical examinations required by the employer.

If your employer thinks one of the above deductions is necessary or legal, your employer is wrong. However, there is one caveat to this statement: Employers can require you to share your tips with coworkers involved in providing services to customers, as long as no portion of your tips goes to a supervisor, manager, or owner.

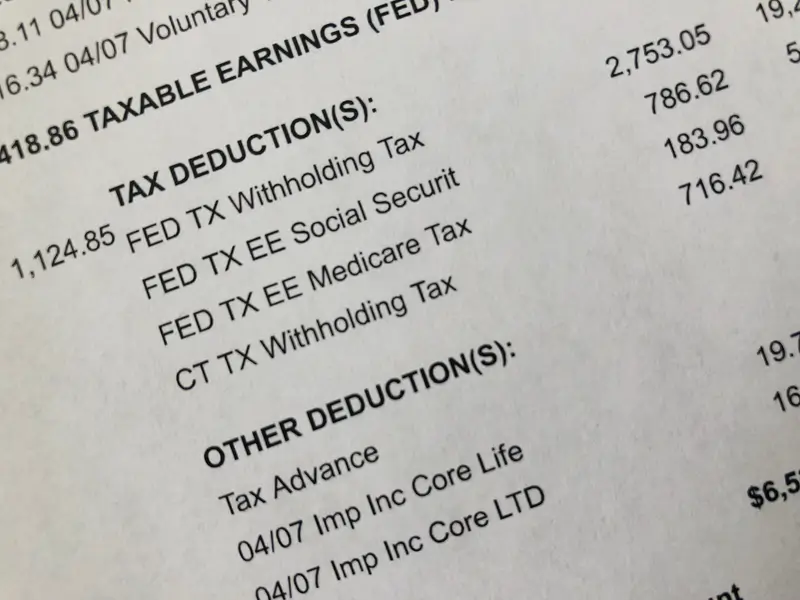

Legal Wage Deductions

While state law prohibits many forms of wage deductions, several paycheck deductions are legal or legally required. Your employer can lawfully take portions of your pay for the following purposes:

- Federal or state income tax obligations;

- To make deductions that you expressly authorized in writing for healthcare dues, insurance premiums, or other purposes, as long as the money taken is not a rebate or wage deduction;

- To dock your pay for any late arrival to work (but only in proportion to the amount of working time you missed or for 30 minutes of your working time at a minimum);

- To fulfill garnishments on your wages; or

- To make deductions authorized by a wage agreement or collective bargaining agreement to cover health and welfare or pension payments.

The above-listed deductions are legal, but you should still inspect your paycheck and consult an employment attorney if you notice discrepancies. Remember, you have the right to review your payroll records, so you can demand payroll information from your employer if you do not have it already.

Contact us if you have any concerns about deductions you see in your paycheck. A Workplace Rights Law Group attorney can help ensure that your employer takes only appropriate amounts from your paycheck and pays damages and penalties for any noncompliance with the law.

How Can I Hold My Employer Accountable for Making an Illegal Deduction?

If your employer violated Labor Code section 221 by making an illegal deduction, you can seek relief through a civil lawsuit or an administrative complaint. If you choose to file an administrative claim, you must file it with the Division of Labor Standards Enforcement (DLSE), also known as the California Labor Commissioner’s Office.

When you file a DLSE claim, a Deputy Labor Commissioner reviews your case and decides whether to dismiss your claim, refer you to a conference, or refer you to a hearing. Some employees and employers resolve their disputes during conferences.

However, some employers and employees need a hearing to address the wage claim. Having the help of a wage and hour lawyer during all stages of a wage claim or lawsuit can be crucial to successfully asserting your wage rights.

What Remedies Can I Recover in a Wage Claim?

If your claim against unlawful deductions is successful, you can recover your unlawfully deducted wages and additional penalties.

If you no longer work for your employer and it made an illegal deduction from your final paycheck, you could be entitled to a waiting time penalty based on your daily pay rate and how long you had to wait for a proper final payment. Our attorneys can ensure that you receive the maximum of every remedy available to you in your claim.

Contact Workplace Rights Law Group Today

Your employer must respect your rights and pay you properly for your time and hard work. If that doesn’t happen, you should call us.

At Workplace Rights Law Group, our experienced wage and hour attorneys are passionate about protecting the rights and livelihoods of employees in California. We have previously represented employers, so we are in the best position to defeat them in employment hearings, trials, and negotiations.

We bring our top-rated advocacy to every case and focus on each client’s unique needs so they receive the best outcome for their situation. When you are ready to speak to one of our skilled attorneys, you can reach us by phone, or you can contact us through our website. The initial case review is free.

Where You Can Find Our Glendale, CA Office

Where You Can Find Our Riverside, CA Office