In today’s workforce, flexible and unconventional employment arrangements abound for employers and employees.

One example is ”per diem” jobs, which have gained popularity across different industries.

But what is per diem work, and how does it differ from traditional employment?

A per diem job in California is a flexible work arrangement where employers employ individuals on an as-needed basis, often in temporary or part-time roles.

Per diem employees do not have a regular schedule. Instead, they work the hours their employers assign them, which can fluctuate.

Keep reading to learn more about per diem work in California, its income tax implications, and the benefits it provides.

If you have any questions, please call our qualified wage and hour lawyers at 818-446-1045 today.

So, What Is Per Diem Work?

”Per diem” is a Latin term that translates to “per day.”

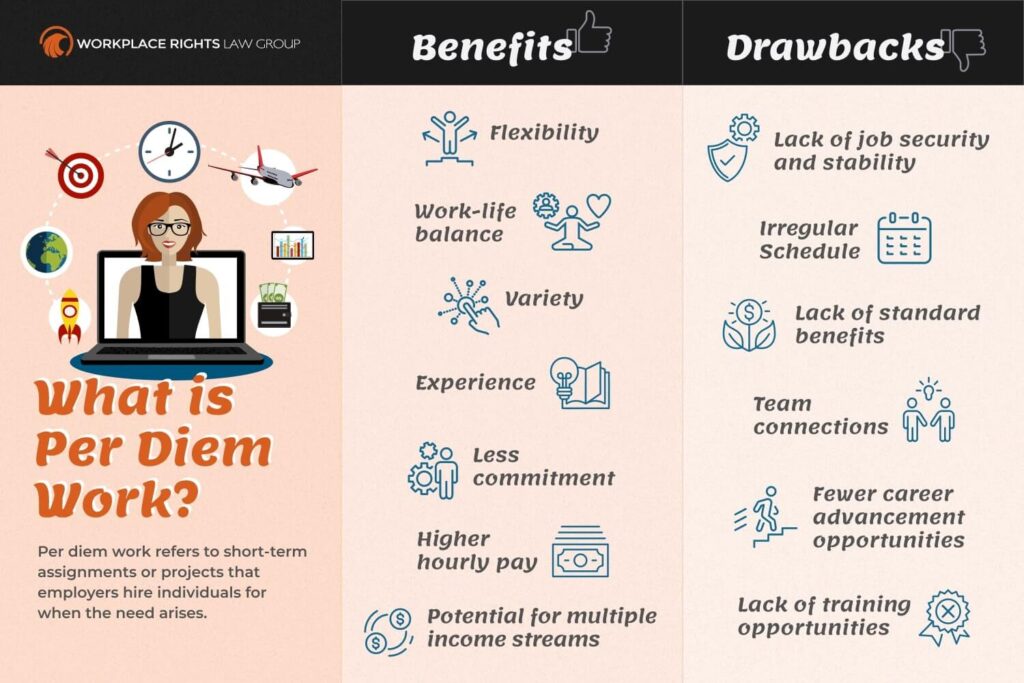

Per diem work refers to short-term assignments or projects that employers hire individuals for when the need arises.

Overall, per diem arrangements benefit both employers and employees. They allow employers to fill staffing gaps without committing to long-term employment.

Per diem employees in California are entitled to certain rights regarding overtime pay, except when exempt based on their role and industry. According to California labor laws, per diem workers should receive compensated 10-minute breaks for every 4 hours of work, similar to other employees.

On the other hand, employers commonly require per diem employees to work irregular hours, including weekends and holidays, and may ask them to travel to different locations.

While per diem jobs can provide flexibility and variety, they may be less stable than full-time employment and may not offer the same benefits or job security.

Are Per Diem Workers Considered Employees?

Per diem workers are similar to independent contractors. However, they are typically considered company employees, while contractors are not.

This means they are entitled to the same minimum wage, overtime pay, and other labor protections as other employees.

But unlike full-time or part-time employees, per diem employees are not guaranteed weekly hours or committed to a fixed schedule.

Instead, employers call on them when they need their services or expertise and pay them a flat daily rate.

Does Per Diem Count as Income?

California considers per diem payments income. But are per diem payments taxable income?

Since per diem employees receive compensation for their services, the Internal Revenue Service (IRS) considers it taxable income and requires employees to report it on tax returns.

Similarly, the IRS requires employers to report per diem payments on Form W-2, Wage, and Tax Statements.

Do Per Diem Employees Get Benefits?

Employers do not have to provide per diem employees with the same benefits as full-time or part-time employees.

Regardless, some employers still offer limited benefits, such as access to a 401(k) plan or paid sick leave, often prorated based on the number of hours worked or length of service.

Depending on the circumstances, federal and California labor laws may also require employers to provide per diem employees with specific benefits, such as unpaid sick leave, workers’ compensation, and overtime pay.

For example, the Affordable Care Act (ACA) considers any employee who works more than 30 hours a week a full-time employee, which means they are entitled to health insurance. So if a per diem employee works full-time, their employer must offer them healthcare coverage.

In every case, per diem employees must carefully review a job offer’s terms to understand the benefits the employer does or does not provide.

Per diem employees and employers must also keep careful track of per diem hours to ensure employers comply with all federal regulations.

Failure to do either can lead to workplace disputes, requiring the services of an experienced employment lawyer to uphold the per diem worker’s rights.

What Are the Pros and Cons of Per Diem Work?

Some people find per diem labor an excellent option, while others find it less desirable. Before accepting per diem work, consider the pros and cons.

Some of the benefits of per diem work include:

- Flexibility. Employees can work when they want and refuse shifts when they don’t.

- Work-life balance. Employees often pick and choose when and where they want to work.

- Higher hourly pay. Employers usually pay per diem workers higher rates.

- Variety. You might work in different departments or facilities or with various teams.

- Experience. Working on various teams can help you build experience and more quickly advance your career.

- Opportunity for full-time employment. Some organizations use per diem positions as a “trial period” leading to a full-time job.

- Less commitment. Per diem work allows you to test out different environments without a long-term commitment.

- Potential for multiple income streams—you could work for multiple employers simultaneously.

For the right individual, per diem work presents numerous beneficial advantages traditional work environments lack.

But per diem work is not for everyone. Drawbacks include:

- Lack of job security and stability. You’ll never know when you’ll be asked to work or receive your next paycheck.

- Irregular schedule. Employers offer per diem positions on an as-needed basis. There’s even a possibility that you won’t get enough work to pay the bills.

- Lack of standard benefits. Per diem workers don’t receive the same benefits as full-time employees, meaning they have to pay out-of-pocket for health insurance.

- Fewer team connections. Per diem employment might make it harder to build relationships or feel like part of the team.

- Fewer career advancement opportunities. Some employers might prioritize full-time staff for promotions or advancement opportunities.

- Lack of training opportunities. Some employers might prioritize regular staff for ongoing training or professional development sessions.

Per diem positions offer unique freedoms. But they also come with uncertainties and potential challenges that workers should thoroughly consider.

When deciding whether per diem work is right for you, it’s essential to weigh these pros and cons against your personal preferences, career goals, and life situation.

Contact the Wage and Hour Lawyers at Workplace Rights Law Group Today

At Workplace Rights Law Group, we believe every employee’s struggles and stories are unique.

That’s why we take a custom approach to each case, exchanging cookie-cutter employment law tactics for personalized one-on-one advocacy for Southern California employees.

Between us, we have nearly 100 years of combined experience.

We’ve spent much of it representing employers, so we know how they operate, giving us an edge in the battle for employee rights.

Contact us online or call 818-446-1045 for a free case review if you have employment law questions or concerns.

We’ve recovered over $10M for deserving clients and are eager to explain how we can help you.

Where You Can Find Our Riverside, CA Office Location

Where You Can Find Our Glendale, CA Office Location