Do you need help understanding California minimum wage laws? If so, Workplace Rights Law Group can address your questions and concerns.

California, like other states, sets a minimum wage that employers must pay their employees.

Failure to pay the required wages is a serious offense, and workers might be entitled to back pay.

This raises an important question: What is the minimum wage in the state of California?

The simplest answer is that, for 2022, the minimum wage is $14 per hour for employers with 25 employees or fewer and $15 per hour for employers with more than 25 employees.

And the state rates for minimum wage in California in 2023 will increase (see below for more information).

However, there are some important exceptions to those general rules.

At Workplace Rights Law Group LLP, our Los Angeles wage and hour claims attorneys are committed advocates for employee rights.

Here, our legal team has put together a guide to California’s minimum wage laws.

If you have any questions or concerns about California minimum wage, or if you were unlawfully underpaid, please do not hesitate to contact or call our California employment lawyers at (818) 844-5200 to set up a free, fully confidential consultation.

Current Minimum Wage in California

In April of 2016, California Governor Jerry Brown made national headlines when he signed the state’s $15 per hour minimum wage bill into law — putting California on the leading edge of raising worker pay.

Under the law, California’s minimum wage is currently scheduled to gradually increase until it hits the $15.50 per hour mark on January 1, 2023.

One of the key things that employees need to know about our state’s minimum wage laws is that, for the time being, there are two separate tiers — one that applies to small businesses and one that applies to larger businesses.

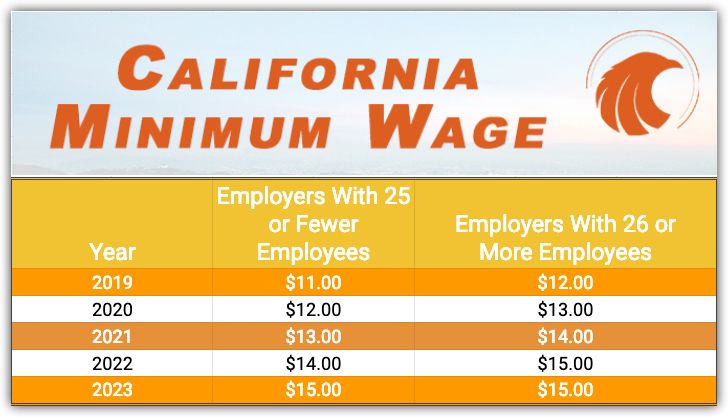

For example, in 2019, the minimum wage was as follows:

- $11.00 for employers with 25 or fewer employers

- $12.00 for employers with 26 or more employees

And with each year, California’s minimum wage has increased on the first of the year. In the next few years, the wage will be the following:

2022

- $14 on January 1, 2022, for employers with 25 or fewer employees; and

- $15 on January 1, 2022, for employers with 26 or more employees

2023

- $15.50 on January 1, 2023, for employers with 25 or fewer employees; and

- $15.50 on January 1, 2023, for employers with 26 or more employees

2024

Beginning on January 1st, 2024, California’s minimum wage for employers of all sizes will be indexed to inflation.

Indexing wages is a policymaking technique that is used to adjust income payments — (Social Security benefits, minimum wage, etc.) — in accordance with the price levels.

The purpose is to ensure that the true ‘purchasing power’ of the minimum wage remains consistent.

Although it may sound a little bit complicated, the effect of this type of policy is fairly straightforward: The state’s minimum wage will be designed to be equivalent to $15.00 per hour in 2024 dollars.

Notably, by 2023, the gap in the minimum wage between small businesses and larger businesses will disappear.

Those are California’s statewide minimum wages. Depending on the county or city in which you live, there could be a higher minimum wage than the statewide requirement.

Note: The above-listed figures are California’s statewide minimum wage. Employers in the state are required to pay workers at least this amount. While the minimum wage in California is currently $15 per hour for employers with more than 25 employees and $14 per hour for employers with 25 or fewer employees, the minimum wage in some California jurisdictions is set at a higher level. Depending on the county or city in which you live, there could be a higher minimum wage than the statewide requirement. You can check UC Berkeley’s list of California City and County Current Minimum Wages to review the minimum wage rates in your area. If you have any specific questions about local minimum wage laws, please do not hesitate to contact our Los Angeles wage and hour claims lawyers for immediate assistance.

Pay Attention to Local Laws: The Minimum Wage is Higher in Certain Jurisdictions

Across the state of California, many local jurisdictions have set their own minimum wage laws above the state’s minimum mandated level.

One of the most noteworthy examples is the City of Los Angeles.

As of July 1st, 2018, the minimum wage in Los Angeles began at $12.00 per hour for employers with 25 or fewer workers and $13.25 for employers with more than 25 workers.

On July 1st, 2019, the minimum wage in Los Angeles rose to $13.25 for smaller employers and $14.00 for larger employers.

On July 1st, 2020, the minimum wage in Los Angeles rose to $14.25 for smaller employers and $15 for larger employers.

The city hit a $15.00 per hour minimum wage for all companies in the summer of 2021 — more than eighteen months ahead of the state as a whole.

And for 2022, the minimum wage rate for all businesses in unincorporated Los Angeles County is $15.96, while the minimum wage rate for all businesses in Los Angeles is $16.04.

Many other jurisdictions across the state also have minimum wage rates that are significantly above the level set by state law. This includes Malibu, Pasadena, Santa Monica, and many cities all throughout the San Francisco Bay area.

Some other jurisdictions have minimum wage rates substantially higher than Los Angeles. In fact, Emeryville has the highest minimum wage rate for any size employer, requiring minimum pay of $17.68 per hour.

It is a good idea to check up on your city or county minimum wage regulations.

Your employer has a legal duty to abide by those regulations. If your employer is violating a local minimum wage ordinance, you should contact an experienced California employment lawyer as soon as possible.

The Exceptions: Paying Less than Minimum Wage in California

California’s minimum wage laws are fairly broad. Indeed, the overwhelming majority of workers in the state are covered by the state’s minimum wage laws.

That being said, there are some limited exceptions.

If one of the exceptions can be met, then California law does allow an employer to pay less than the minimum wage.

Some of the most notable minimum wage exceptions in California are as follows:

Disabled Workers

An employer can pay an employee with disabilities less than the minimum wage, but must have a license from the California Labor Commissioner’s Office (Also called the Division of Labor Standards Enforcement) to do so.

Paying a sub-minimum wage is seen as a way to incentivize hiring disabled workers. This exception exists for certain limited situations: employers should not be allowed to take advantage of it for financial profit.

Trainees

A trainee (or “learner”) can receive 85% of the standard minimum wage, but not less, for the first 160 hours. A trainee must have no prior experience in the field.

Similar to the disability exception, some employers improperly classify already skilled workers as trainees.

Apprentices

An employer can pay an apprentice less than the standard minimum wage. Apprentice wages are set by the Industrial Welfare Commission.

Once again, it is crucial that this exception is only used in the appropriate circumstances.

Immediate Family Members

Immediate family members are exempt from California’s minimum wage laws. This includes spouses, parents, and biological/adopted children.

As an example, a small business owner could pay their son or daughter to work a part-time summer job at a rate that is below minimum wage in California.

Outside Sales People

In California, outside salespeople are also exempt from many wage and hour regulations — including minimum wage regulations.

An outside salesperson is one who spends more than half their time away from the business, working directly on sales. Generally, their compensation is heavily based on commissions.

With all of these exceptions, it is important to remember that they are designed to meet narrow, limited circumstances.

For example, California does not allow employers to pay non-trainee learners or student learners less than the minimum wage.

Employers should also not try to illegally classify someone as a trainee when they have experience in the field.

In far too many cases, employers attempt to stretch the state’s minimum wage exemptions well beyond their breaking point.

If a company improperly applies any minimum wage exemption to you, you should consult with an attorney.

You deserve your full and fair wages.

WRLG Attorneys Take Employment Law Cases on a Contingency Fee Basis

If you have a legitimate employment law claim, for example if you feel your employer is not following California minimum wage laws, you should seek legal advice immediately. You shouldn’t be denied quality legal representation because you are worried about paying lawyer fees. At WRLG our attorneys represent workers on a contingency fee basis. This means that we get paid only if we recover money for you. We invite you to contact our firm today to find out whether you have a valid claim.

What About Salaried Professionals?

California’s wage orders do not apply to a worker who is deemed a “professional” depending on their job duties and salary.

Under California wage orders that cover overtime pay and California minimum wage in 2022, salary-exempt, professional employees do not enjoy the same wage protections as others.

To be salary-exempt, an employee must have one of the following positions with the following corresponding salary:

- An executive position that involves earning a salary that equals at least two times the state minimum wage for full-time employment;

- An administrative position that involves earning a salary that equals at least two times the state minimum wage for full-time employment; or

- A professional position that involves earning a salary that equals at least two times the state minimum wage for full-time employment.

To be exempt from California’s wage orders, your job duties must match one of the categories listed above — your employer cannot shirk wage order obligations if you are an executive, administrator, or professional in name only.

If your employer neglects to pay you sufficiently because of an exemption, speak to an experienced wage and hour attorney about whether the exemption applies to your circumstances.

What About if I Receive Tips?

One of the biggest distinctions between California’s minimum wage laws and the minimum wage laws of most other U.S. states is how employees who receive tips are handled.

Unlike the vast majority of other states, California does not let employers pay a sub-minimum wage to employees who receive tips, such as waitresses and waiters.

Instead, all employees must receive at least the minimum.

The law also does not allow employers to take tips earned by their employees.

Tips belong to the worker, though an employer can require that employees pool all or a portion of their tips.

After pooling, an employer will distribute them according to set criteria.

Tipped employees may run into wage-related issues for a wide range of reasons.

If you or your loved one is a tipped worker, and your minimum wage rights were violated or you believe that your tips were unlawfully confiscated by your employer, please contact an experienced Los Angeles wage & hour attorney right away.

How Do Minimum Wage Laws Affect Independent Contractors?

California’s minimum wage laws apply to employees in the state. Independent contractors, who are, by definition, not employees, are thus not covered by minimum wage regulations.

Unfortunately, many workers across the state are misclassified as independent contractors.

Worker misclassification is a serious form of employer misconduct: it prevents employees from getting access to full and fair protection under the law — including protection under state and local minimum wage regulations.

If you believe that you may have been misclassified as an independent contractor, you should speak to an experienced California employment attorney immediately.

Worker misclassification cases are complex; there is no one set definition of an ‘independent contractor.’

Many different factors must be reviewed to determine if a worker is properly classified.

That being said, if you are working as an independent contractor, you might be misclassified if the following circumstances apply to your work:

- You have little to no control over your own schedule;

- You have little to no say in how much work you take on;

- You do not perform work outside the usual course of business for the entity that hired you;

- You do not customarily engage in independent business that is the same as the business of the entity that hired you; and

- There is very tight oversight over how your ‘work’ is performed.

If you were denied a minimum wage or any other employee benefits as a result of worker misclassification, you need professional legal help.

What to Do If You Were Unlawfully Paid Less than Minimum Wage in California

Your labor rights must be vigorously protected. You deserve the full and fair wages that are owed to you.

If your employer has violated your right to receive a minimum wage — for any reason — it is imperative that you take immediate action.

When an employer violates state or local minimum wage laws, they can be held legally liable through a wage claim with a state administrative agency or through a civil lawsuit.

As most wage and hour claims are complex, it is crucial that workers are represented by a top-rated employment attorney.

Your attorney can conduct an in-depth investigation of your case and determine exactly what steps should be taken to protect your rights and get you access to the full wages that you are owed.

You Only Have Limited Time to Bring a Minimum Wage Claim

If you are being unfairly underpaid by your employer, the time to take action is now. Under California state law, there are strict deadlines that workers must follow when making minimum wage claims.

Indeed, California generally has a three-year statute of limitations for minimum wage violation suits.

Should you fail to initiate your legal claim in the required amount of time, you could lose out on the right to get the back wages that are owed to you.

Beyond the statute of limitations, the longer you wait to take action, the more challenging it will be to obtain and assemble all relevant evidence.

Contact a California wage and hour lawyer to set up your free case evaluation today.

Do You Have Questions About California’s Minimum Wage Law?

At Workplace Rights Law Group LLP, our Los Angeles wage & hour claims lawyers have helped countless employees get the full and fair wages they deserve.

If you believe that you or your loved one was unlawfully paid less than minimum wage, our employment law attorneys can help.

Our legal team is here to answer any questions you might have about the minimum wage laws in California.

To get a free, fully private review of your case, please call (818) 844-5200 or submit an online message.